Tax Prep for Financial Advisors: Don't Forget These Three Crucial Components

If you’re a financial advisor who offers a holistic planning approach and helps clients with taxes, there are likely components you pay specific attention to, such as strategies to lower clients’ taxable income. For comprehensive financial planners who want to include tax planning strategies in their clients’ financial plans, you’re going to want to know three crucial components that many forget about. As a bonus, these three tax preparations will also be useful for retirement planning and healthcare planning.

Medical Tax Deductions

The medical tax deduction is worth considering for any individual or family who has large, unreimbursed medical expenses that exceed 7.5% of their adjusted gross income, even if they might not typically itemize their tax deductions. For this tax season (filing for 2025 in 2026), the standard deduction is $15,750 for single filers and those married filing separately, $31,500 for joint filers and surviving spouses, and $23,625 for heads of household.

Aside from everyday costs like doctor’s visits, prescription copays, and health insurance premiums, your clients can deduct medical expenses such as wheelchairs, home improvements for increased accessibility, lead-based paint removal, and more. However, if your client pays for medical expenses using money from a flexible spending account or health savings account, those expenses aren't deductible because the money in those accounts is already tax-advantaged. It might not be worth the extra work to attempt to claim an itemized tax deduction if your clients’ medical expenses are moderate. Instead, it might be better for them to take the standard deduction, which is the amount that most taxpayers may deduct from their income to reduce their tax bill if they do not itemize their tax deductions.

Claiming the standard deduction is usually the easier way to do taxes, but if your client has a lot of itemized deductions, add them up and compare them to the standard deduction for their filing status.

For example, let's say a couple is on a Marketplace health insurance plan and paying roughly $22,000 annually in premiums. They have additional healthcare expenses that qualify as deductible expenditures totaling $10,000, meaning their total medical tax deduction amount is $32,000. Let’s say their adjusted gross income (AGI) is $173,340. 7.5% of their AGI is $13,000, so of their $32,000 in deductible medical expenditures, they could deduct $19,000. However, this is less than the standard deduction of $31,500 for joint filers, so it would be more beneficial for the couple to take the standard deduction.

IRMAA

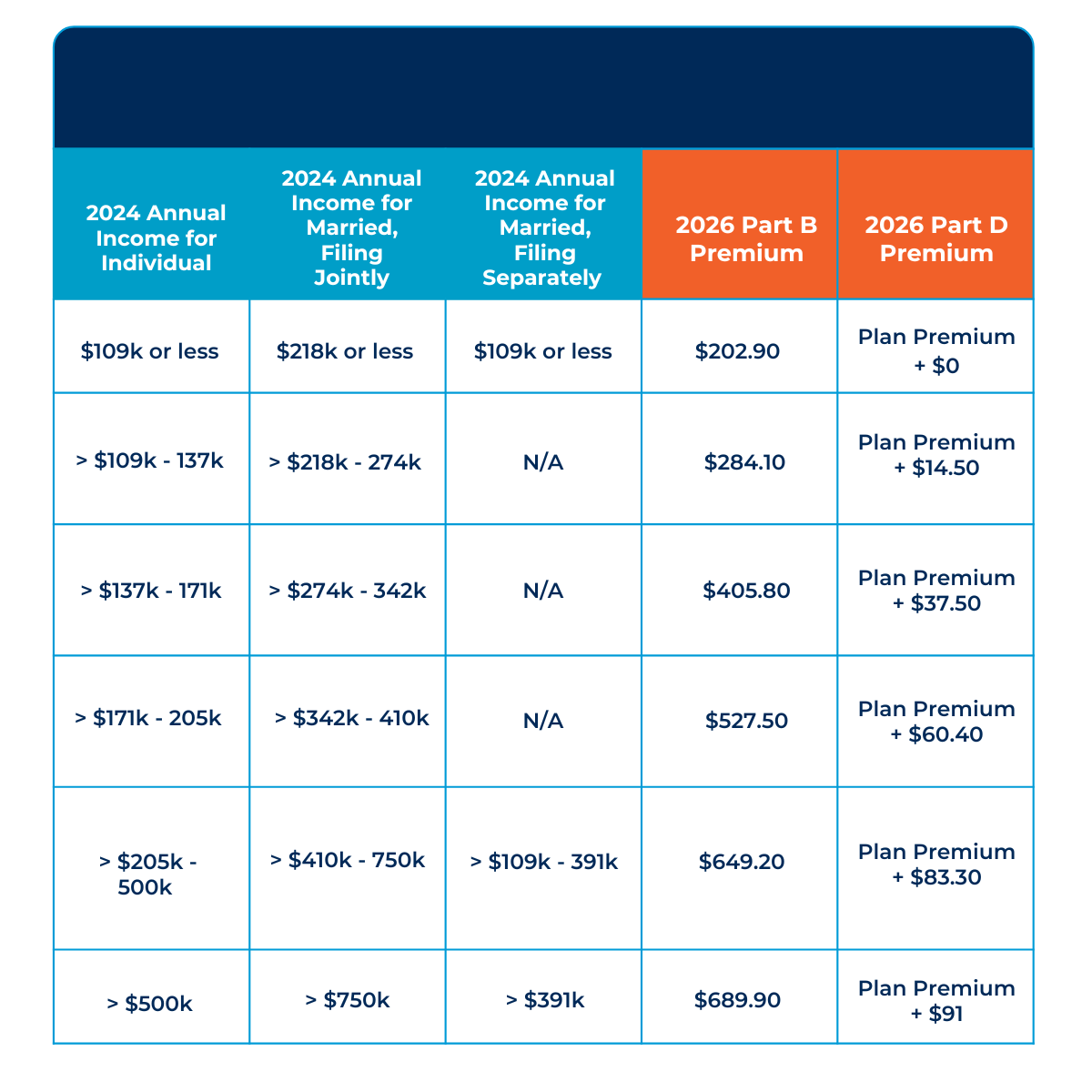

For clients already on Medicare or who are reaching Medicare eligibility soon, IRMAA is a factor you and your clients will want to consider. The income-related monthly adjustment amount (IRMAA) is based on a client’s tax filing status, the current year’s adjustment amount, and their modified adjusted gross income from two years prior. In 2026, the standard base monthly premium for Part B is $202.90. For Part D, your client will pay their chosen plan’s premium, plus a potential income adjustment of up to $91. To calculate your client’s 2026 IRMAA, which is added to these base premiums, the Social Security Administration (SSA) will look at their tax return from 2024. Their Medicare premiums and IRMAA determination are sent to them every year in the fall. Below is a table of expected total costs, which include both the base amount and IRMAA charge:

These costs impact your client’s financial plan, so it’s better to be proactive and plan for them in advance. If your client has a few years until they enroll in Medicare, they might want to take steps now to control their modified adjusted gross income (MAGI) and potentially limit IRMAA.

HSA Contributions and High-Deductible Health Plans

For clients who aren’t on Medicare yet and can enroll in a high-deductible health plan, one tool to utilize is a Health Savings Account (HSA). Health Savings Accounts are beneficial because of the triple-tax advantages they offer. An HSA allows your clients to contribute pre-tax, or tax-deductible, money to a savings account, thereby lowering their taxable income. They can then invest those contributions, and the earnings from those investments can grow tax-free as well. If they withdraw the money for qualifying medical expenses, those withdrawals won’t be taxed either.

An HSA can also be used as a way to build money for your client’s retirement since they can withdraw money for any reason penalty-free after they turn 65—they’ll just have to pay income taxes on money used for non-medical expenses. Because of the tax-free growth, your clients should carefully consider when it’s best to pay for medical expenses out of their own pocket vs. using their HSA funds. As their financial advisor, you can guide them on what decision is more appropriate for their situation. As mentioned at the start, HSAs are only available with high-deductible health plans. So your client will also need to consider their health utilization, needs, and preferences before choosing to enroll in a high-deductible health plan.

Moving Forward

These are all important considerations to keep in mind before, during, and after tax season. Since it’s tax season, now is a great time to bring these factors up to clients. This, in turn, can make it easier to talk about healthcare costs and health plan optimization strategies with clients, which will ultimately lead to a more well-rounded financial plan.