How To Help Clients Conquer A Top Retirement Fear

Before we dive into strategies and tips to help your financial planning clients conquer the fears keeping them from retirement, let’s talk about what those fears are.

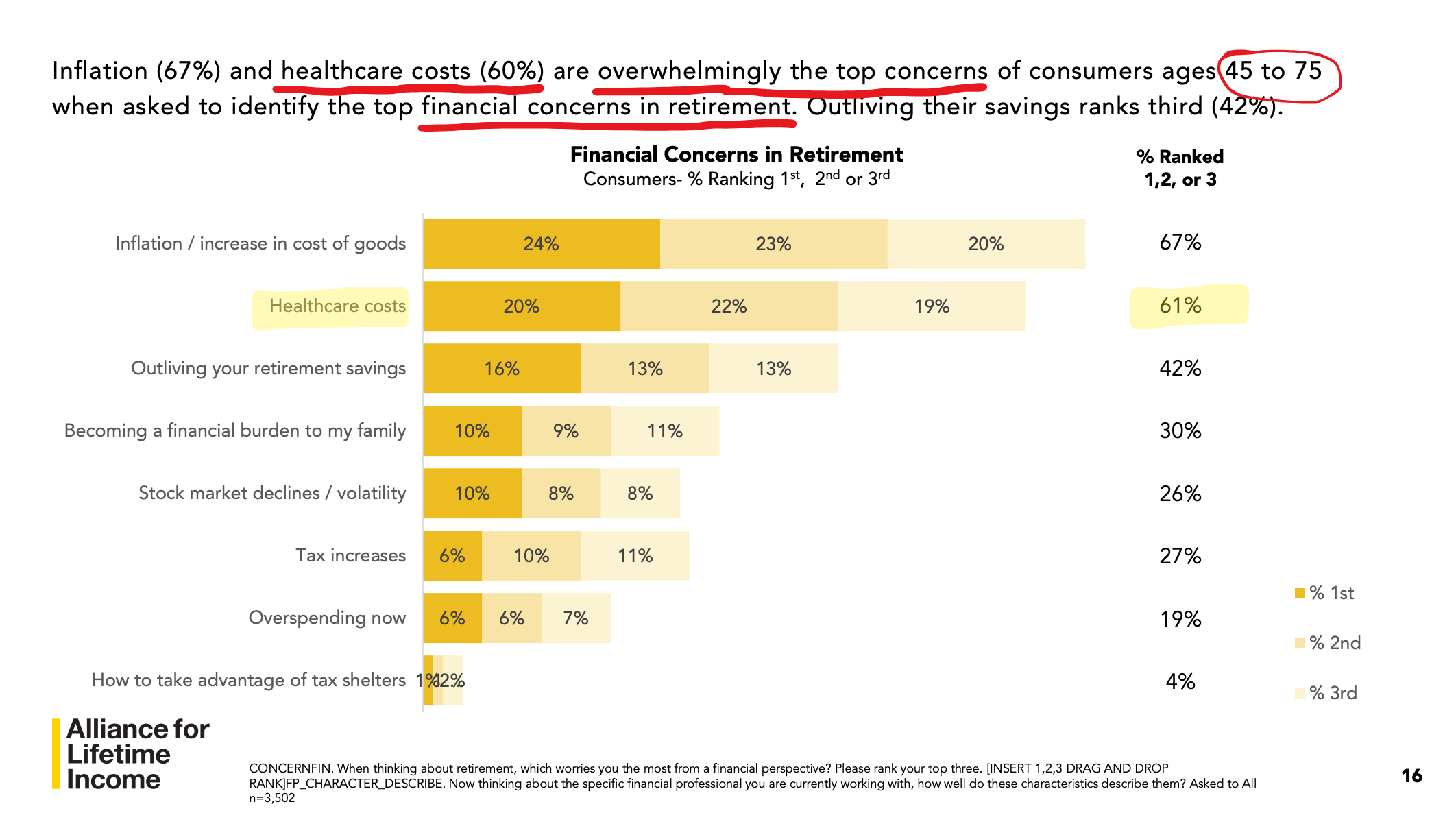

Everyone has different fears and anxieties, but several studies come out each year revealing the most common ones among Americans. Without fail, one that always cracks the top three or top five is healthcare-related.

Just this year, Alliance for Lifetime Income by LIMRA’s 2025 Protected Retirement Income & Planning study found that consumers who work with a financial professional cite healthcare costs as their second-highest worry in retirement (62%). Meanwhile, financial professionals listed healthcare costs third (50%) in clients’ top concerns.

And since clients list “peace of mind” as one of the most important values of having a financial advisor, financial planning professionals must address these healthcare cost concerns if they want to retain clients. Plus, healthcare is the third-highest expense in retirement, so if you’re not incorporating this into a retirement plan, you and your client might be in for an unpleasant surprise down the road.

So, how can you, a financial advisor, help clients conquer one of their top retirement fears?

Well, Bryan Hodgens, senior vice president and head of LIMRA Research, suggests:

“Financial professionals could consider using software that projects healthcare costs and scenario planning to address the need as an additional strategy to focus the client on the outcome.”

How to incorporate healthcare planning into retirement planning

If your goal is to account for healthcare costs in clients’ retirement plans without becoming a healthcare expert, your most time-effective and cost-efficient solution will likely be healthcare planning software. This is an ideal solution for keeping healthcare planning “in-house” without adding any additional tasks to your already-full plate.

You could go with average national estimates, but that doesn’t consider each client’s specific needs, preferences, and life events. Plus, you don’t create generic, average financial plans, so why would you add generic, average healthcare costs to a client’s plan?

A second option is to go with your local broker, but they’re often limited in which plans they can sell and are often restricted to specific geographic locations. You could even go with Medicare call centers that are large brokers, but that exposes you to poor client experiences and high-pressure sales tactics. Plus, Medicare call centers only help your clients who are 65 and older.

For most advisors, the most cost-effective, comprehensive option for healthcare planning is to partner with a third-party healthcare planning company that combines the power of technology with expert guidance for Medicare and pre-65 health insurance.

This solution is also ideal for clients, since an Orion survey found that most investors want their financial advisor to collaborate with third-party professionals (like CPAs and attorneys) in some capacity, either on all financial matters or when a specific issue arises. Additionally, Envestnet, Inc. found that 62% of U.S. investors prefer or already use a single financial provider for all their needs. Their research also found that investors expect holistic advice.

The solution to conquer clients’ fear of healthcare costs negatively impacting their retirement plan is simple: plan for healthcare costs! And lucky for you, the financial advisor, Move Health makes it possible to do so without becoming a health insurance expert.

Final Thoughts

Depending on how you decide to offer healthcare planning, the cost can vary greatly. But the good news is that using Move Health to address client concerns around healthcare costs less than what most financial planning firms spend on office supplies in a year: $750 annually per advisor on the platform.

At Move Health, we partner with financial advisors all over the country to equip them with the healthcare planning capabilities they need to incorporate clients’ health insurance and medical costs into their comprehensive financial plan. When advisors partner with Move Health, they gain access to our award-winning software and an expert team of non-commissioned, licensed agents to provide insights and planning opportunities based on clients’ unique circumstances. From initial analysis to enrollment, our tech-enabled, human-driven approach to healthcare planning ensures you and your client have clarity and confidence at every step of the process. Most importantly, we uphold the same fiduciary responsibility that you do—to provide clients with the information and support they need to make the best choice for their healthcare coverage.

So, if you want to help clients conquer a top retirement fear, you can’t neglect healthcare costs. And the most efficient and effective way to plan for healthcare costs in retirement is through third-party healthcare planning software, like Move Health.