Medicare Part D Explained: A Quick Guide for Financial Advisors

Let’s start this blog with a few stats:

The top two key areas that people without financial advisors say they want guidance on are retirement income planning and Social Security/Medicare advice.

Additionally, one study found that the majority of clients (65%) expect health insurance advice from their advisor, but only 4% receive it.

It's clear clients want their advisor’s guidance when it comes to Medicare, but to do that, you, the advisor, need to know the basic parts of Medicare. Don’t worry, you don’t need to become an expert, but having a solid understanding of the core components of Medicare will take you far.

One of these core components is Medicare Part D. Keep reading to learn everything you need to know as a financial advisor about Medicare prescription drug coverage!

What is Medicare Part D?

Original Medicare is made up of four parts:

- Medicare Part A (Hospital Insurance)

- Medicare Part B (Medical Insurance)

- Medicare Supplemental (“Medigap”)

- Medicare Part D (Drug Coverage)

Medicare Part D is specifically for drug coverage. If your client enrolls in Original Medicare, they’ll want to select a stand-alone prescription drug plan even if they don’t currently take any prescription medications.

Why?

If your client doesn’t enroll in Part D during their Initial Enrollment Period and goes more than 63 days without creditable drug coverage, they’ll be charged a Late Enrollment Penalty (LEP) fee. The Part D LEP fee will be applied indefinitely, regardless of whether your client changes plans. The LEP fee adds an extra 1% of the “national base beneficiary premium” for each month your client does not have creditable drug coverage for as long as they do have Part D coverage. If your client has creditable coverage and waived Part D, they'll need to check every year that their plan still meets the guidelines for the upcoming year, as changes to Medicare Part D might affect the client's plan's qualification.

The national base beneficiary premium amount changes each year ($36.78 in 2025 and $38.99 in 2026), and the penalty fee will be rounded to the nearest $0.10 and added to your client’s monthly Part D premium. Many Americans don’t know this and are unpleasantly surprised to learn that this penalty sticks with them for life.

As an advisor who understands the basics of Part D, you can help your clients avoid LEP fees and deepen the level of trust in your advisor-client relationship.

Are Part D plans offered through Medicare?

Although Medicare Parts A and B are offered by Medicare, Medicare Part D plans are provided by private insurance companies that contract with the federal government. If a beneficiary’s preferences align with Original Medicare over Medicare Advantage, it’s advisable to enroll in a private Medicare Part D plan to provide truly comprehensive coverage and avoid an LEP fee. Without a Medicare Part D plan, your clients will be paying entirely out-of-pocket for their medications.

How much does Medicare Part D cost?

Each drug plan has its own formulary and separates drugs into different tiers, which affects overall drug costs. The pharmacy your client uses can also have an impact on their drug costs since not all pharmacies are considered in-network with all drug plans. However, for covered drugs, Medicare enrollees won’t pay more than $2,000 in out-of-pocket costs. For drugs that aren’t covered, enrollees will have to pay the full cost of those prescription drugs.

Aside from actual drug costs, your client will also pay a monthly premium for their Part D drug plan. Again, the cost of this premium will depend on the individual plans. This year, there are some plans with a $0 monthly premium; however, it’s important to remember that the lowest monthly premium doesn’t automatically mean a plan is the right choice for your client. Your clients, with your guidance, should review all actual costs before enrolling in a plan.

(Hint: this is something Move Health can help you easily do.)

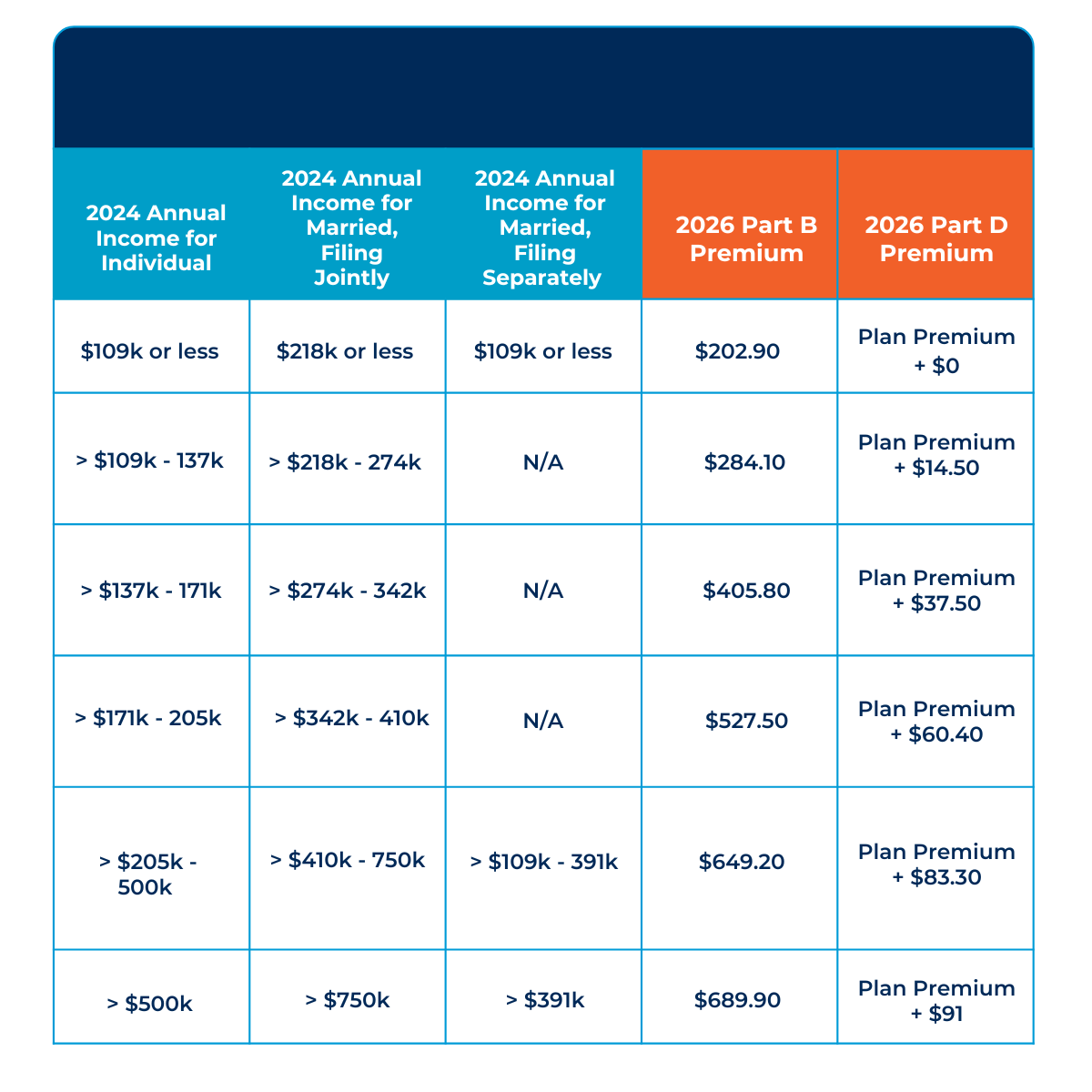

Additionally, your client’s income plays a part in how much they pay each month for Part D (and Part B) coverage. This income-related monthly adjustment amount (IRMAA) is based on your client’s tax filing status, the current year’s adjustment amount, and your client’s modified adjusted gross income from two years prior.

For 2026, the standard base monthly premium for Part B is $202.90 and increases based on the income band that your client falls within. For Part D, your client will pay their chosen plan’s premium plus their associated income adjustment. Below is a table of expected total costs:

Are there any medications that Medicare Part D doesn’t cover?

All Medicare drug plans, generally, must cover at least two drugs per drug category, but plans can choose which drugs covered by Part D they will offer. All Part D plans must cover all drugs available in the categories below:

- Cancer drugs

- HIV/AIDS treatments

- Antidepressants

- Antipsychotics

- Anticonvulsants

- Immunosuppressants for organ transplants

Part D plans must also cover most vaccines, except for vaccines covered by Part B.

Drugs not covered by Part D include:

- Drugs for weight loss or gain, even if used for non-cosmetic purposes, except (in some cases) to treat physical wasting caused by AIDS, cancer, or other diseases

- Fertility drugs

- Cosmetic and hair growth drugs

- Cough and cold drugs, when prescribed for symptomatic relief only, without an underlying medical indication

- Erectile dysfunction drugs

- Vitamins and minerals, except prenatal vitamins and fluoride preparations

- Non-prescription drugs (over-the-counter drugs)

Final Thoughts

If your client chooses to enroll in Original Medicare, they’ll need to also enroll in Medicare Part D and select a drug plan to ensure they have truly comprehensive health insurance and aren’t subject to an LEP fee.

We covered drug coverage for Original Medicare, but not Medicare Advantage. While that operates very similarly, the drug coverage is embedded within a chosen Medicare Advantage plan, which includes medical coverage. Stay tuned for future blogs about Medicare Advantage!

The information in this blog can help you guide clients to the right Part D coverage for their needs, but to truly make healthcare planning a seamless experience for clients and yourself (and to avoid getting too many details about your clients’ medical needs), schedule a call with our team to learn how Move Health’s healthcare planning software and team of licensed agents supports financial goals and makes you the ultimate comprehensive financial advisor.